Chưa có sản phẩm trong giỏ hàng.

how do you get a payday loan?

Just how to Refinance a cellular Household within less Rates

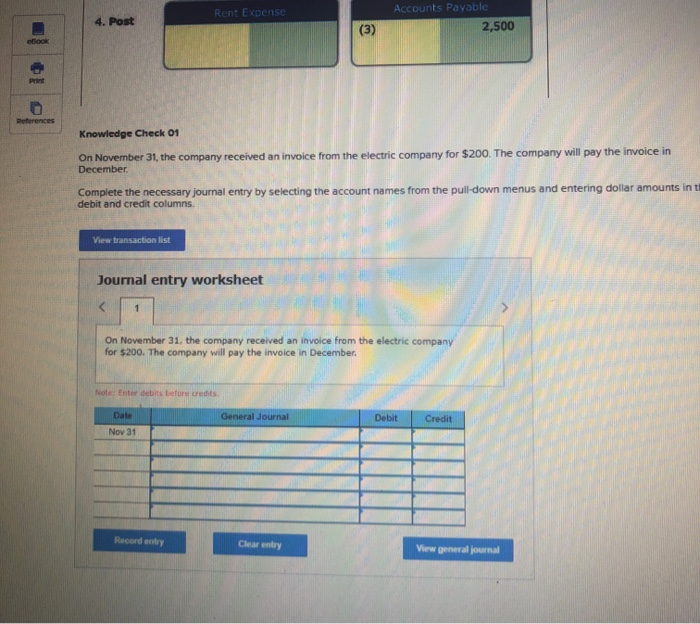

There are no credit check loans Leighton many reasons so you can re-finance a loan: You may also change to less interest rate, decrease your monthly installments, or mark a lot more loans. To possess high money, such as lenders, refinancing can help to save a fortune in the end. This is also true for those who own cellular belongings, and do not keeps mortgages but rather possess chattel money.

A great chattel financing funds a cellular household because the a piece of private possessions rather than because a home. As a result, the interest costs during these finance are usually much higher than just exactly what an interest rate manage demand. Which higher rate will leave the property owner with an enormous monthly payment and you will a hefty number of attention along the life of their mortgage.

One-way one cellular home owners can also be down this type of can cost you is with refinancing. Of the altering their chattel loan towards a mortgage loan you could save your self a fortune along side longer term.

Secret Takeaways

- Many mobile home is financed by the a good chattel mortgage unlike a mortgage, and you will chattel money enjoys much higher rates of interest.

- Cellular land you to definitely fulfill certain requirements can convert on the real estate for example getting qualified to receive a home loan.

- Two of the chief hurdles of getting a mortgage for the an excellent cellular household is actually a bona-fide home identity and you will a long-term base.

- If you’re able to proceed with the procedures needed to move your financing so you can a mortgage, you may also save yourself a lot within the focus and you can monthly obligations.

Refinancing a mobile Household

Refinancing your existing mobile household chattel mortgage towards a mortgage can take certain performs, however it is worth every penny to the costs you’ll save. For 1, you could secure much lower rates of interest throughout the loan name. Really chattel finance has pricing of eight% to help you well over a dozen%. For the majority of of 2020, rates on the 31-seasons fixed mortgages have been significantly less than step 3.5%, and this development is a lot a similar towards 2021.

The way to get a home loan

Nevertheless, once the tempting as the a mortgage may seem, to have a cellular the home of qualify for these types of mortgage there are several even more difficulties. Even though the accurate standards may vary somewhat by the bank by county, brand new cellular domestic will have to satisfy specific sorts of the fresh following:

- It needs to be intent on a long-term, fixed base.

- It cannot keeps rims, axles, or a good pulling hitch.

- It ought to was in fact based shortly after Summer 15, 1976.

- It should provides a foundation that fits the brand new Service off Property and you will Urban Development’s criteria.

- It should have a genuine property label, not your own possessions name.

There are a few the way to get to this type of laws, and this we will enter soon. Oftentimes, the most significant issue with refinancing a mobile mortgage is founded on changing the fresh residence’s newest personal possessions term towards a genuine home identity.

How exactly to Become a real Estate Identity

In a few says, you will find a clear-cut procedure based on how to transform an individual assets term on the a real estate name. Most frequently there are most detail by detail laws for what a property are and is maybe not. In other states, it could be more difficult.

Just like the bringing a concept was an elaborate judge processes, you are able to enlist a genuine home lawyer to have let. You are able to consult a region name company understand the specific measures.

Once you work on the brand new term organization to convert the fresh title, you can then begin shopping around having mortgages. You’ll want to work at lenders which offer finance on the cellular residential property. Not all the lenders give this type of money.

How to handle it or even Qualify

Though it is much simpler discover a bona fide estate title (and you can a mortgage loan for instance) for individuals who individual the fresh new land the cellular home is placed on, you will find exclusions. For people who lease your lot inside the a mobile house area otherwise out of some kind of a property owner, then you may nonetheless be considered beneath the Government Homes Administration’s Title step one system. To be eligible for a title step one home loan, you ought to:

An attached base can cost only $step 3,five hundred otherwise around $twelve,000 or more. Owner matters, although final price depends primarily to your impact of your own household.

Brand new Government Property Administration keeps extremely tight requirements having mobile household loads, internet sites, or teams, so make sure you like your own (as well as your property manager) with alerting while you are thinking about providing a name step 1 mortgage financing.

There are many will set you back that include refinancing their mobile family which have a mortgage loan. Some are people who have any home loan processes, however you may need booked a little extra money to purchase most laws and regulations for mobile home.

Basic, be aware of the consequences in your fees. Chattel taxation and you may home taxation will vary, so you could owe a lot more (otherwise smaller) after you transfer their name.

There is going to also be will cost you so you can procedure and you can over your own mortgage financing. Given that when selecting a fundamental house, you’ll need to shelter a down-payment, lender charges, settlement costs, so there are almost every other charge, as well. Such is dependent on your lender otherwise broker, therefore the costs it costs for every financing.

For individuals who hired assist any kind of time phase (like into name, otherwise a real estate agent to research tons, or even to test a web site), so it cost of labor can also add to your total cost mark too.

Lastly, without having a long-term base, add that it cost to the listing as well, since you’ll need they to convert to a real property term.