Chưa có sản phẩm trong giỏ hàng.

how much of a cash advance can i get

Compliant Money: Will they be Good for you?

While looking for an alternate house, you can pick from several financing affairs to greatly help financing your buy. Because of so many choice, mortgage brokers and bodies businesses play with consistent assistance to spell it out and you may classify mortgage brokers. Conforming loans make up one of those classes. Cracking the latest code on this subject sort of home loan isn’t as challenging as it can sound, and it can help you decide what kind of financing is most effective for you.

What does compliant imply?

The key to skills conforming financing is created straight into new term. These are typically any and all mortgage loans one follow authorities-backed firm (GSE) recommendations depending of the authorities. Whatever does not see these requirements is named a non-conforming financing and more than mortgage loans often belong to that class otherwise the other. GSE guidance become limits with the home loan beliefs, downpayment items, loan papers, and you can certification requirements for obligations-to-earnings rates, borrowing from the bank histories, and credit ratings.

What are these tips having?

GSE guidelines are prepared by Federal Houses Finance Service and decide which mortgages are found by the us government eg Fannie Mae and you will Freddie Mac computer. These economic businesses are available by the Congress to keep the fresh housing marketplace liquids, steady, and you may affordable.

Fannie mae and you can Freddie Mac computer package, get, and sell mortgage loans to save industry swinging. However, while the riskier mortgages are more likely to fall into standard and potentially ruin the business, they have to work on minimizing that opportunity. This is where the rules can be found in. Non-compliant loans can be riskier, that is the reason they cannot be bought otherwise marketed of the Fannie Mae otherwise Freddie Mac.

Just what exactly are the constraints?

A number of different facets can also be push that loan out-of compliant to help you non-conforming. The greatest foundation are home loan size. For a financial loan to fit well within the principles it can’t getting for more than:

Generally, mortgages which can be more than $424,100 are merely too-big to-fall towards compliant class. In fact, mortgage loans bigger than the constraints are known as jumbo money plus they are usually a small riskier than simply their compliant counterparts. Hence, jumbo funds has stricter qualification requirements and might hold highest costs.

Can restrictions and you will recommendations change?

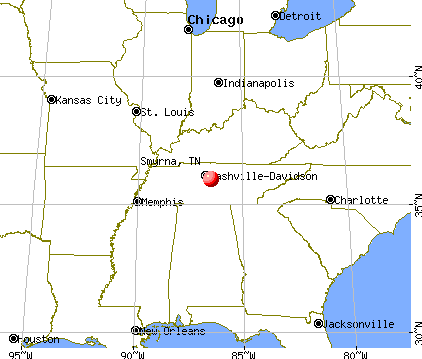

Loan restrictions depend on median home values and since rates fluctuate into field, the new restrictions can transform too. Brand new $424,100 base limit is relatively https://cashadvanceamerica.net/ this new and you will was only created in , before one to conforming funds just weren’t allowed to be for over $417,000. As the cost can also changes according to place, urban centers having steep places possess higher constraints. Mastering precisely what the limits is to suit your town is as as simple calling the financial banker, they are going to have the ability to of one’s details you need to help you choose the best mortgage for your requirements.

Just what more makes that loan non-compliant?

Though size is the most common, it is really not the only component that normally push a loan to your non-conforming area. Specific equally important explanations one to financing will start floating out from the guidance were:

As with most legislation, there are some exclusions these types of. Such as for instance, some apps getting earliest-time homeowners help to promote a reduced downpayment with no mortgage having to getting a low-conforming loan.

Perform each other categories of fund has advantages?

Sure! Neither particular financing is fundamentally a lot better than others. Knowing what type is the best for you utilizes everything you want out of your mortgage. Compliant financing are great while they usually have all the way down rates, that help save you a pile of cash ultimately. This type of mortgage loans together with tend to be more steady investment, so that they can have practical, a whole lot more versatile underwriting conditions. Non-conforming loans are usually riskier expenditures, and thus he has stricter underwriting criteria and may also hold highest rates. But these are typically a good option should you want to use an effective greater than mediocre amount of cash to suit your dream house. The best thing to keep in mind is the fact that the most readily useful financial is just one that suits your money and can assist you are free to the dreams. So many different things will come towards enjoy whenever determining in the event that that loan could well be conforming otherwise non-compliant, that makes with issues otherwise finding advice regular. To own solutions regarding the compliant fund, non-conforming funds, or other things associated with your home to purchase excursion, consult your financial banker now otherwise find home financing banker towards Atlantic Bay.